Markets

The U.S. Banks With the Highest Exposure to Commercial Real Estate

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

U.S. Banks With the Most Commercial Real Estate Exposure

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Today, there is roughly $5.7 trillion in commercial real estate debt outstanding—with U.S. banks holding approximately half of this total on their balance sheets.

The commercial property sector, which includes office, retail, healthcare, and multi-family properties, has faced mounting pressures amid high interest rates and lower occupancy levels. Given these headwinds, it poses the risk of higher defaults and steep loan losses in a sector that has not fully recovered since the collapse of Silicon Valley Bank last year.

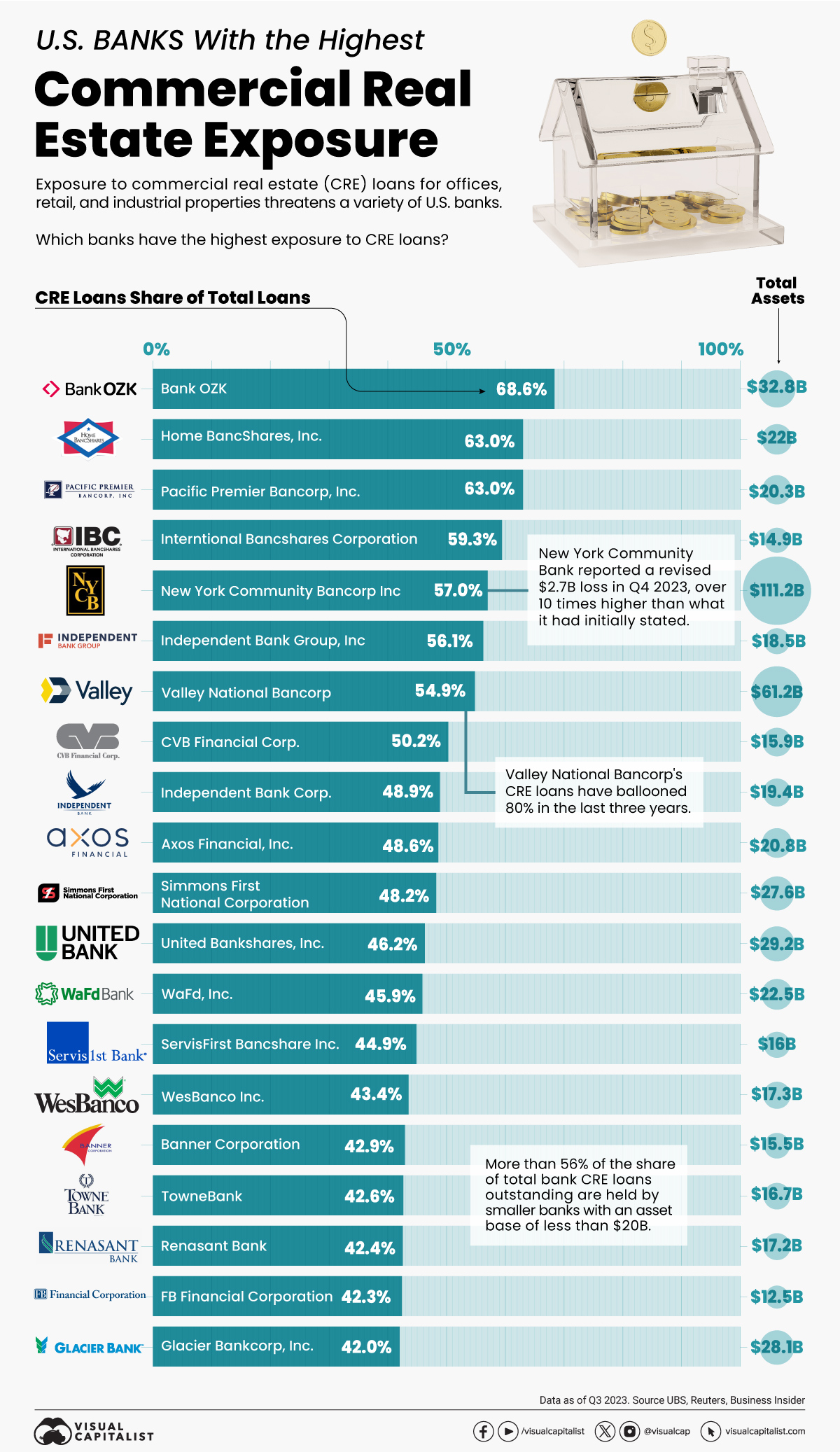

This graphic shows the U.S. banks with the highest exposure to the commercial real estate sector, based on analysis from UBS.

Top U.S. Banks, by Share of Commercial Property Loans

Here are the banks with the greatest concentration of commercial property loans as of the third quarter of 2023:

| Bank | Commercial Real Estate Share of Total Loans | Total Commercial Real Estate Loans | Total Assets |

|---|---|---|---|

| Bank OZK | 68.6% | $17.4B | $32.8B |

| Home BancShares, Inc. | 63.0% | $9.0B | $22.0B |

| Pacific Premier Bancorp, Inc. | 63.0% | $8.4B | $20.3B |

| International Bancshares Corporation | 59.3% | $4.7B | $14.9B |

| New York Community Bancorp Inc | 57.0% | $49.0B | $111.2B |

| Independent Bank Group, Inc. | 56.1% | $8.0B | $18.5B |

| Valley National Bancorp | 54.9% | $27.5B | $61.2B |

| CVB Financial Corp. | 50.2% | $4.5B | $15.9B |

| Independent Bank Corp. | 48.9% | $7.0B | $19.4B |

| Axos Financial, Inc. | 48.6% | $8.3B | $20.8B |

| Simmons First National Corporation Class A | 48.2% | $8.1B | $27.6B |

| United Bankshares, Inc. | 46.2% | $9.8B | $29.2B |

| WaFd, Inc. | 45.9% | $8.1B | $22.5B |

| ServisFirst Bancshares Inc | 44.9% | $5.2B | $16.0B |

| WesBanco, Inc. | 43.4% | $4.9B | $17.3B |

| Banner Corporation | 42.9% | $4.6B | $15.5B |

| TowneBank | 42.6% | $4.8B | $16.7B |

| Renasant Corporation | 42.4% | $5.3B | $17.2B |

| FB Financial Corporation | 42.3% | $4.0B | $12.5B |

| Glacier Bancorp, Inc. | 42.0% | $6.8B | $28.1B |

As the above table shows, the vast majority of banks with the greatest exposure are small and medium-sized financial institutions.

Bank OZK, based in Arkansas, has the highest proportion of commercial property loans, at 68.6% of total loans. As one of the country’s most prominent lenders to Manhattan property developers, its share price has outperformed the S&P 500 by tenfold since going public 27 years ago.

New York Community Bancorp, the only big bank on the list, has $49 billion in commercial property loans, making up 57% of its overall loans. At the height of regional banking turmoil last year, one of New York Community Bancorp’s subsidiaries took over the failed Signature Bank in a multi-billion dollar deal.

Since the bank reported $2.7 billion in losses in the fourth quarter of 2023, its share price has plummeted roughly 68%. The surprise loss—which was revised from $252 million—prompted the bank to seek a $1 billion lifeline from investors to help shore up confidence in the institution. Former U.S. Treasury Secretary Steven Mnunchin was a major investor in the deal.

Like New York Community Bancorp, a number of other regional banks have seen their share prices lag due to its fallout.

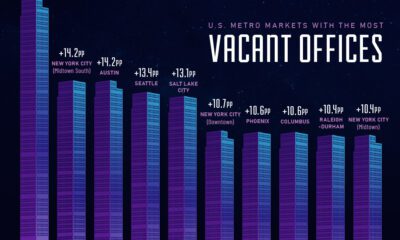

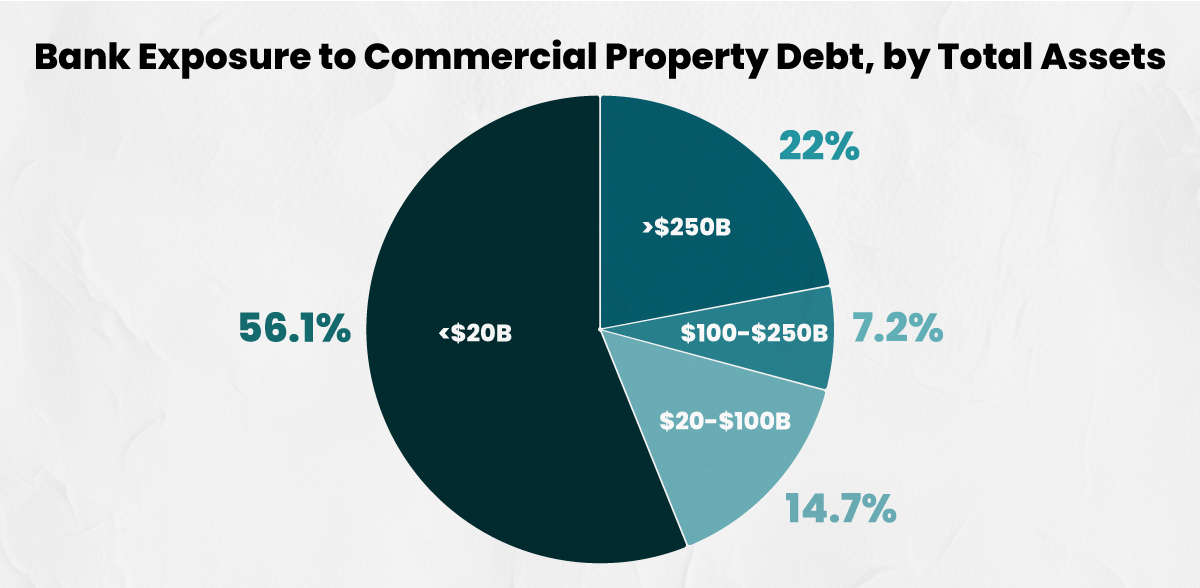

Commercial Property Debt Concentrated in Small Banks

Below, we show how the majority of commercial real estate loans are found in small U.S. banks, which are those with assets of $20 billion and under:

With 56.1% of all commercial property loans, small U.S. banks face the highest risk compared to other bigger banks.

Given the high share of loans, banks may run the risk of failure especially if credit losses accelerate and valuations decline. At the same time, it could be more challenging to refinance debt as valuations deteriorate.

While these troubles have begun to emerge over the last year, there is also the likelihood that losses could continue over the next several years. In fact, after the global financial crisis, credit losses peaked two years after delinquencies hit their highest point.

Markets

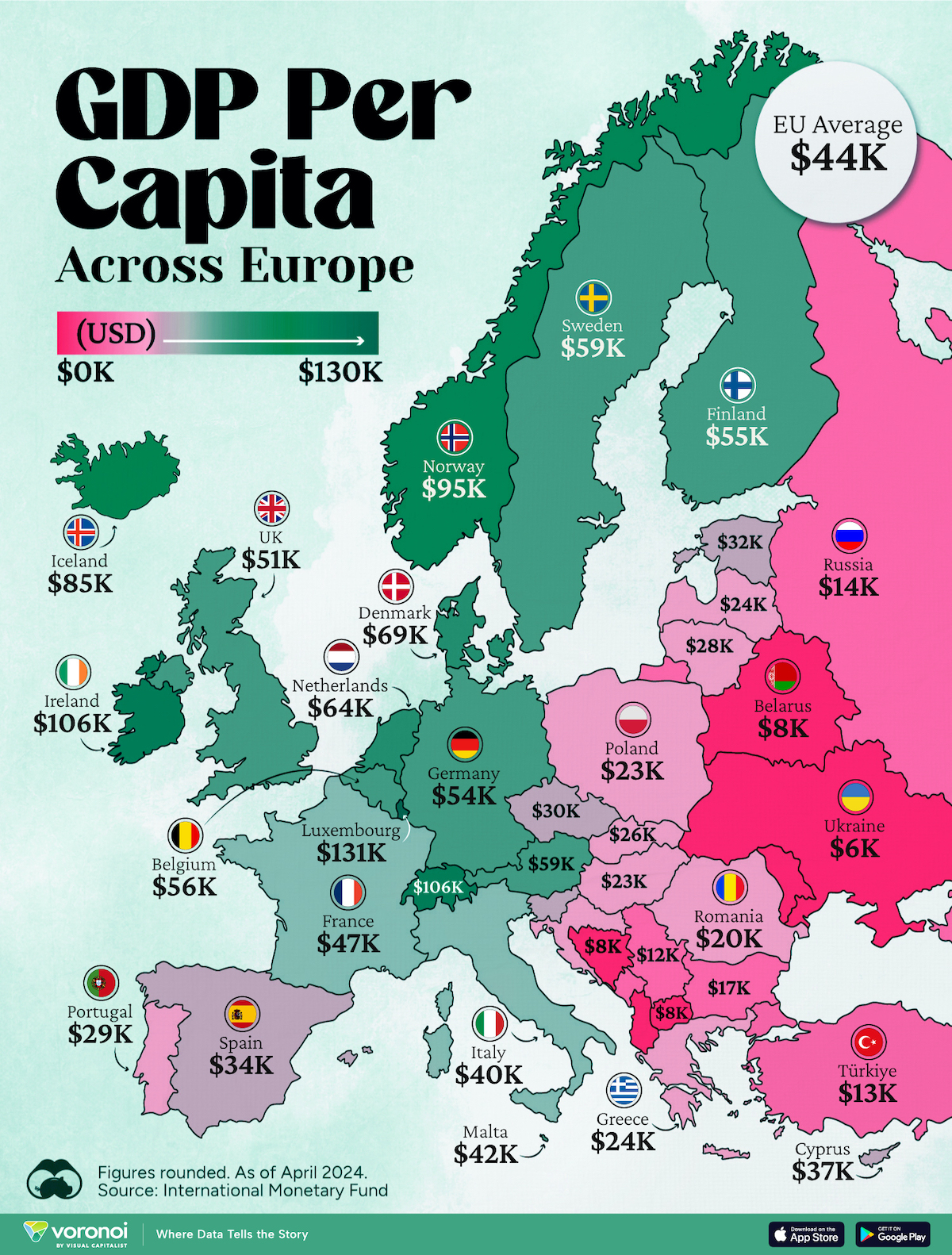

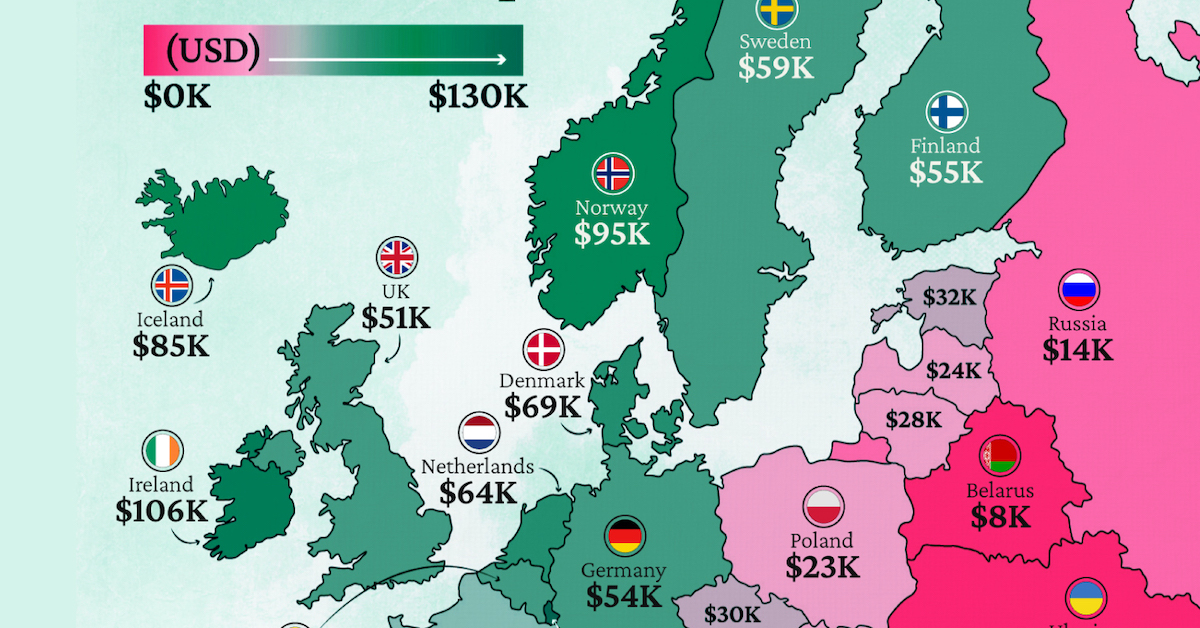

Mapped: Europe’s GDP Per Capita, by Country

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn